Transformative TechOptometrists today have more tools than ever at their disposal to help detect, treat and manage disease. To help you keep up with the constant innovation, the September 2024 issue of Review of Optometry—our 47th annual technology report—reviews the pros and cons of telehealth in optometry, new devices in eye care and the future of remote monitoring. Plus, find the results of our annual tech survey to discover which clinical instruments your peers are buying or desiring. Check out the other articles featured in this issue: |

Fall is when most ODs turn their attention to goal-setting for the coming year. What do you want to shoot for in 2025—adding new skills and procedures? Boosting office productivity? Patient retention? A healthier bottom line? More breathing room in the daily schedule? Those are usually among the top options, and there’s any number of ways to pursue them without spending a penny, of course, but they are all key motivators that guide purchasing decisions for a practice.

To stay competitive and continually provide the best care, optometrists must make informed decisions when investing in new equipment. We recently conducted a survey of ODs on their priorities and considerations when purchasing new technology. This article delves into the key findings, providing insights for optometrists looking to make strategic investments. In all, 155 optometrists took the time to share their real-world stories and experiences with us.

Taking the Plunge

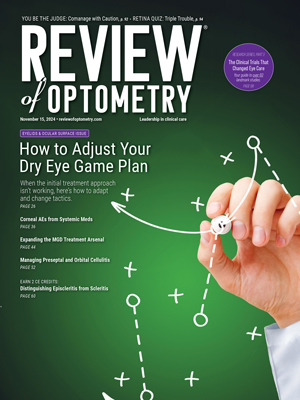

A significant majority of optometrists have invested in new medical technology in the past two years, according to our survey. Specifically, 64.5% of respondents confirmed that they had made such investments (Figure 1). This finding underscores the importance of staying current with technological advancements to enhance practice capabilities and patient care.

|

| Click image to enlarge. |

“Being ahead of technology is what patients expect from their doctors these days,” noted Jaya Pathapati of Amarillo, TX, in her survey response. She recently bought several new devices primarily involving retinal disease diagnosis.

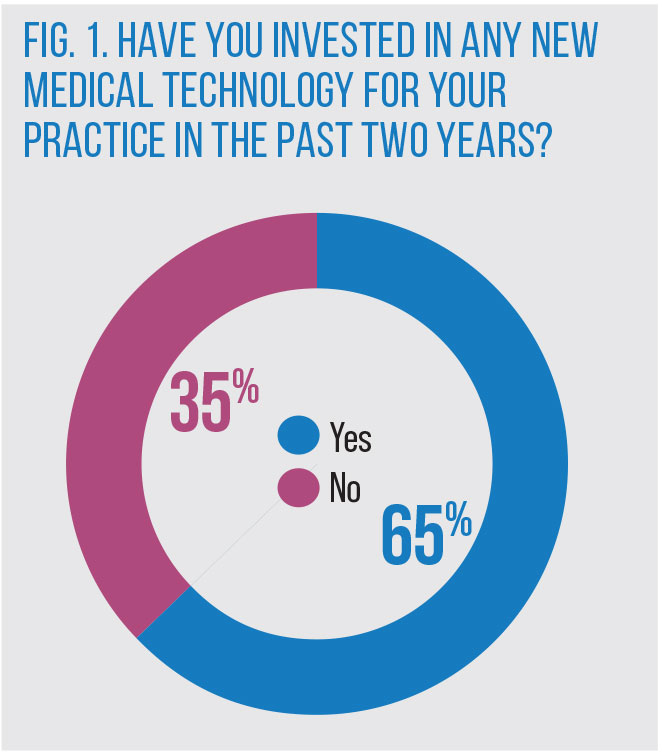

The survey asked optometrists to rate the importance of various factors when purchasing new technology on a scale of 1 to 5 (Figure 2). The top priority was improving patient care outcomes, with a weighted average score of 4.62. “If the new technology doesn’t improve patient care, you are buying it for the wrong reason,” an OD from Idaho wrote.

|

| Click image to enlarge. |

“ODs cannot survive on what we get from vision plans, so the sooner we invest in peripheral equipment, the better off we will be,” wrote Troy Ogden, OD, from Sparks, NV.

The reputation of the manufacturer didn’t make much impact as a whole, ranking second to last among the options with a weighted average of 3.91. However, it’s notable that some of the most emotionally charged comments in the responses came from ODs venting about lousy service, purchase terms or behavior by certain vendors.

One survey respondent who bought a headset perimeter last year lamented that “the tech they sent for us to train was a newbie (week one at his job), he couldn’t answer the most basic questions” and said they returned that device within a week. “If one can’t provide a good staff to train us, I don’t see the value in that device. I need good support from the manufacturers. There are plenty of devices in the market—what sets you apart?”

Another reader concurred: “We look for the company rep to be experienced not only with this product but within the industry itself,” a Wisconsin OD wrote. “They should know what they’re selling and what they’re talking about.”

Coming in last in importance when buying, with a weighted average of 3.72, was the availability of a CPT code linked to use of the device, a plaudit that often gets trumpeted by manufacturers as a selling point.

Reaping the Rewards

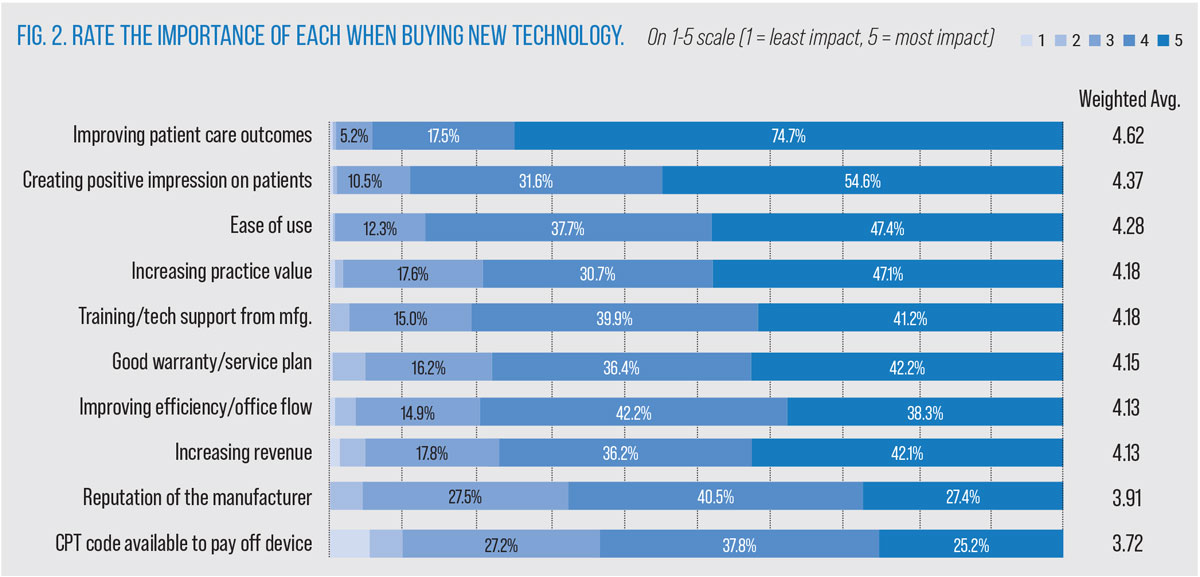

Optometrists who invested in new technology reported notable improvements in various practice metrics. When asked about the impact on profitability, productivity and clinical outcomes (again using a 1-5 scale), the responses were generally positive (Figure 3).

| |

|

For clinical outcomes, 44.2% of respondents reported at some increase and 18.6% called it a significant gain. Combined, that’s a healthy 62.8% of readers who felt their recent purchase delivered on their patient care goals in at least some ways.

Productivity gains from new tech saw a similar trend, with 40.2% reporting at least some improvement and 12.8% noting a significant one—for a “top two boxes” score of 53% reporting productivity enhancements.

Profitability, however, didn’t quite make it past the 50-yard line. While 42.1% of respondents experienced some increase in the bottom line, only 5.3% felt their investment’s ROI was significant last time around. That’s 47.4% overall reporting a positive financial position after their recent purchase. Good, then, that patient care outcomes rank higher in priority anyway.

“Our OCT works great and we love it, but in reviewing reimbursements for OCT we have come to realize that capital equipment is now just a break-even proposition,” one reader commented. “Low reimbursements, and by the time the equipment is paid for, you will likely need a new machine.”

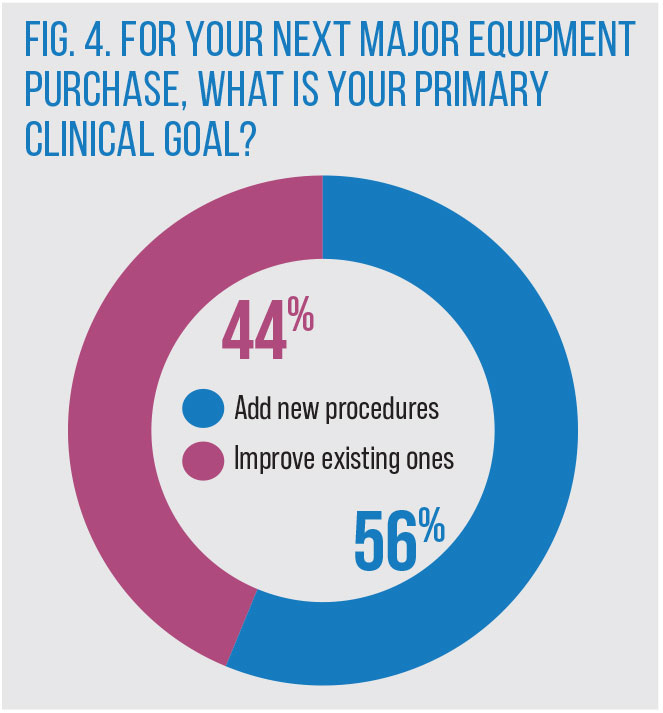

While every medical practice in every discipline needs to periodically upgrade its equipment, a rapidly evolving one like optometry always has an array of new clinical responsibilities to pursue, whether it’s adding specialty contact lens fitting, going deep on dry eye or getting more gung-ho about retinal comanagement. So, it’s no surprise that more than half (56.2%) of respondents said they aimed to add new procedures or services to their practice when considering their next major equipment purchase (Figure 4).

|

| Click image to enlarge. |

Choosing Wisely

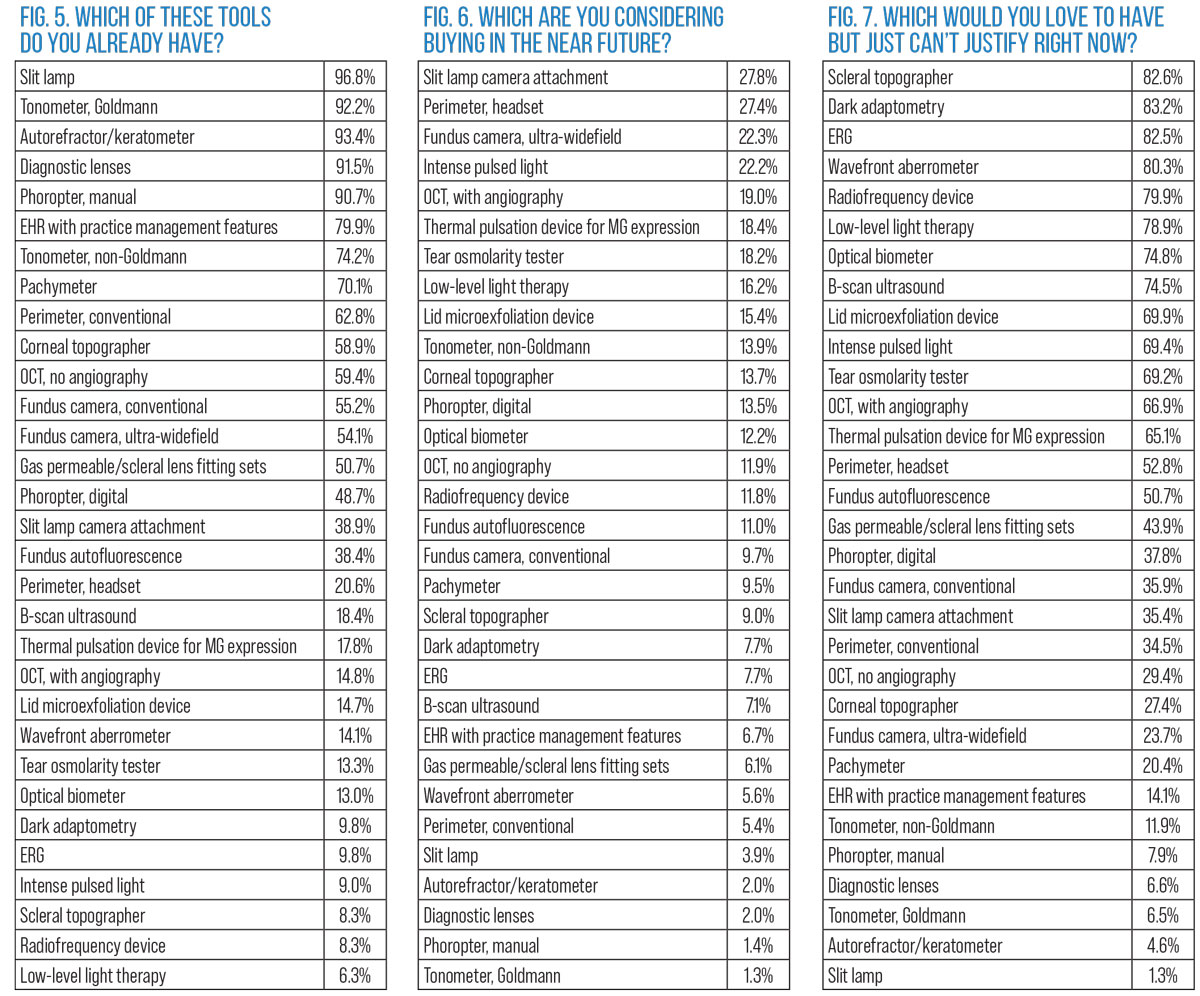

A sizable portion of the survey explored the types of equipment ODs already have, plan to buy and just can’t justify at the moment. You can browse the results in Figures 5, 6 and 7, and see how closely these match up with your own.

The top five tools respondents already have are exactly what you’d expect: slit lamp, Goldmann tonometer, autoref/keratometer, diagnostic lenses and a phoropter—the table stakes for practicing optometry. Things get more interesting after that as trends start to emerge.

Just about three-quarters of ODs in the survey say they have an OCT (74.2%), a respectable gain of 6.9% from two years ago, when we last ran this survey. “The addition of OCT-A opened new clinical capabilities to diagnose and monitor patients,” one OD commented.

EHR systems equipped with practice management capabilities, at 79.9% this year, jumped 15% from 2022’s figure of 64.7%. Of course, this year’s survey pool was different than that of 2022, making direct comparisons difficult. Still, as each of these surveys constitutes a snapshot of the profession at a given time, it’s interesting to note differences between them even if they lack statistical rigor.

One area of care where we feel confident calling out a trend is the adoption of head-mounted visual field testers. In 2022, just 8.5% of respondents had one of these new devices, but they also said it was their second most anticipated purchase. Fast-forward to 2024 and 20.6% of this year’s survey group tells us they’ve got one, a 12.1% gain, and the product category is again among the top three desired purchases for the future, with 27.4% of readers considering one.

Headset perimetry “has been great for staying up to date on latest technologies and provides a ‘wow’ factor that patients love,” wrote one OD from Connecticut.

| |

|

Another encouraging sign in adoption trends is greater uptake of pachymetry, from 57.8% in 2022 to 70.1% this year. With positive movement for that category plus headset perimetry and OCT, optometrists look to be getting more serious about glaucoma management.

Dry eye care—the most crowded category of devices for sure, with purpose-specific products comprising six out of our 31 options—is difficult to characterize. Five of the top 10 wish list items in the 2024 survey are dry eye devices—but five of the top 11 that ODs can’t justify right now are, too.

“There’s a lot of new dry eye tools that I think would add value to the practice and there certainly is a need for it,” wrote Madison Rhoton, OD, of Auburn, ME. “However, we have a lot of tools at our disposal currently and I’d like to become optimally efficient at using those before adding more to the mix.”

Still, dry eye tech demand clearly has some strong indicators in our survey data. When going product by product through the “have it” and “want it” questions, the two product categories with the biggest positive difference (want > have) are both dry eye therapies: intense pulsed light (+13.2%) and low-level light (+9.9%).

Signing on the Dotted Line

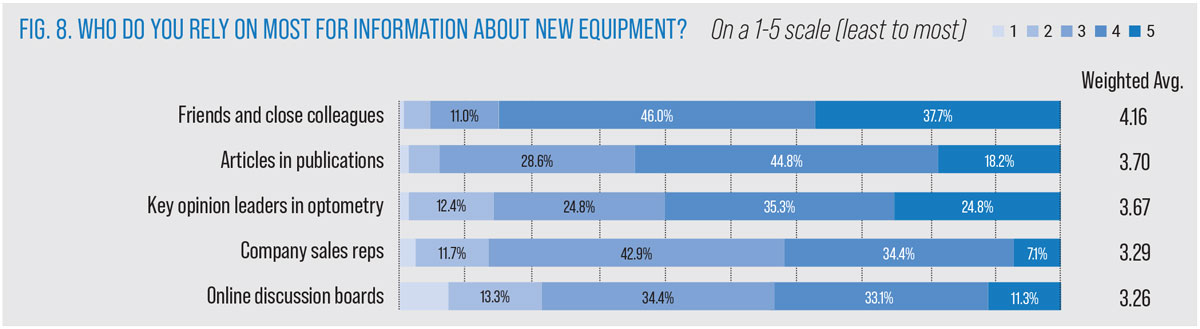

When researching a new purchase, ODs rely on various sources for input on the wisdom of the prospect. Friends and close colleagues were rated as the most important, with a weighted average score of 4.16 on a 1-5 scale (Figure 8). This was followed by articles in publications (3.70) and the advice of key opinion leaders in optometry (3.67); company sales representatives (3.29) and online discussion boards (3.26) didn’t fare as well.

|

| Click image to enlarge. |

“I depend a lot on experiences from people I know,” wrote Mary Hoang, OD, of Tustin, CA. “You can always tell by how they respond to your inquiry to know if the product is good or not. I trust them more than a sales rep or online.”

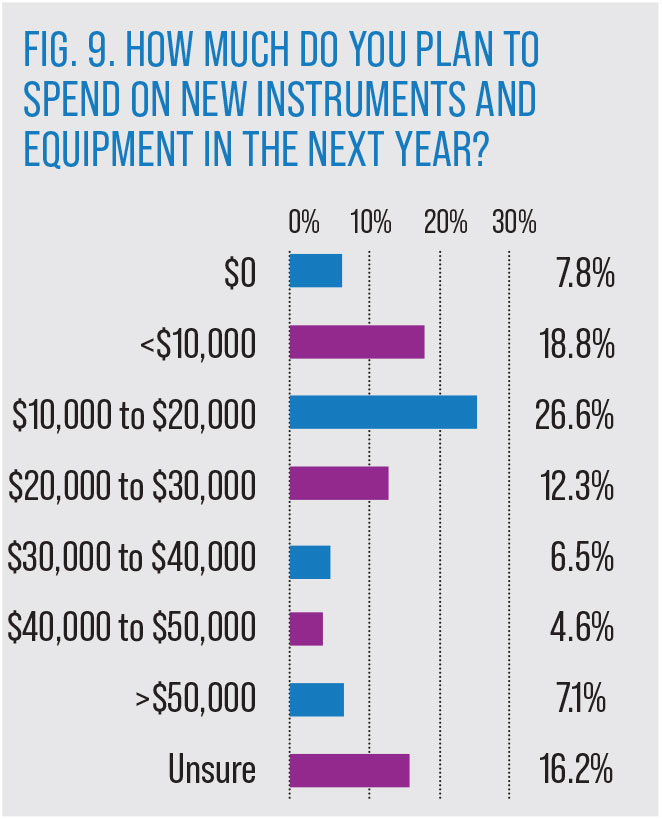

Asked about their budget for new instruments and equipment in the next year, 45.4% intend to keep the investment below $20,000 (Figure 9).

| |

|

“Get multiple quotes,” advised one reader. “You get a feel for the company and decide who you want to give your business.”

Said a reader from Boston, “I like it least when pricing is a mystery and I have to spend valuable time with 30-minute phone calls just to hear a demo/the price of the device. Ranges should be advertised, at a minimum.”

Sales reps focus heavily on ROI; while that’s important, “they need to have realistic numbers and understand our perspective on expectations like life span,” wrote Mark Burke, OD, of Plainfield, IL. “I had a vendor recently tell me how a camera would pay for itself and I looked right back at him and said the wellness images I take now are $39/patient with 96% conversion—will medical images alone pay the $1,250/month if I’m bringing four patients back for retinal evaluations per month?”

Looking Ahead

Buying a new device opens up new possibilities, and that’s exciting, but there are more than a few bumps along the way. “Patients like new stuff, but it’s not always an upgrade on previous equipment in terms of ease of use,” wrote Annette Morgan, BOptom, of Wellington, New Zealand. “And we can’t always compare data from old to new machines, argh!”

With a significant portion of ODs planning investments in the coming year, staying informed through trusted sources is crucial for making strategic decisions. “Generally, enhancing flow and patient benefit takes top priority, with a close second as profitability and equipment filling a need,” Dr. Rhoton summed up.

By understanding these trends and priorities, ODs can make informed decisions that align with their clinical goals and practice needs, ultimately enhancing patient care and practice success.